My client’s situation

My client’s father was diagnosed with Dementia in 2015 and earlier this year told that they may be able to obtain a discount in Council Tax as a result of his condition.

They were unsure if this was accurate information and didn’t know where to start with trying to validate it let alone begin the process of claiming if proven to be true.

Obstacles Facing My Client

- No telephone number available to speak to someone in person at the Local Authority

- Online forms were complicated, confusing and difficult to understand

- Didn’t possess the skills to be able to produce the supporting documentation in the format required

- Time consuming

Initial steps by SimplySolved

Firstly, it was necessary to research the facts and determine whether or not there was a legitimate case to pursue; the last thing that my client needed was any more of their time wasted. The findings verified that the advice provided was indeed accurate and not only was my client’s father entitled to a discount for forthcoming payments, but there was also a possibility of a retrospective claim.

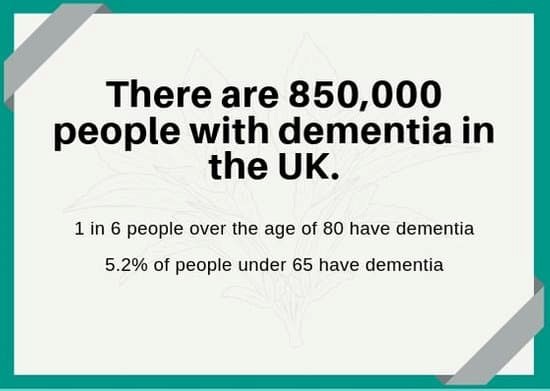

The facts

Sadly it’s not advertised very well, but in England, Scotland and Wales someone who has been medically certified as having a permanent severe medical impairment such as dementia (and is entitled to a disability benefit) could be entitled to a 25% Council Tax reduction if two people are living in the property or an exemption if the dementia sufferer lives alone.

The process for making a claim varies by area but it’s worth being aware that some Local Authorities will also back date claims.

The following links are useful references to begin to understand more if you or a loved one are in a similar situation:

Dementia UK – The Disregarded Discount

Alzheimer’s Society – Council Tax and Dementia

Stockport Council – Applying for Council Tax Support

The process undertaken by SimplySolved

As would be expected, there is a considerable amount of forms that require completing before submitting the claim to request a discount. There is also another entirely different, but just as lengthy, document that needs to be completed when applying for the retrospective rebate.

These were both populated via online forms on the Council’s website.

It was necessary to identify all of the supporting documentation that was needed to evidence the claim and then obtain this from my customer. It’s also worth mentioning that as my client was making the claim on behalf of his father, there was also an additional form that had to be filled in to prove his involvement/interest.

The restrictions placed on the upload of the supporting paperwork, by the Local Authority, made the process labour intensive and lengthy. Copies of everything were retained for reference purposes and just in case anything got lost in transit!

To avoid any unnecessary stress, I was detailed as the email contact for the Local Authority for any questions that they had in terms of clarifying matters. After liaising with my client, these were all responded to in a timely manner to ensure that the process was not delayed unnecessarily.

The Result

Just six weeks after both claims were submitted, my client’s father received a refund of four years’ worth of council tax and a future exemption put in place so no more payments are required

One very happy client!

Does the situation sound familiar?

If you are feeling in a similar position and don’t know where to begin, contact me on 07402 126616, email debbie@simplysolved.uk or complete the form below and I would love to help you get back something that you are genuinely entitled to.